inheritance tax waiver form michigan

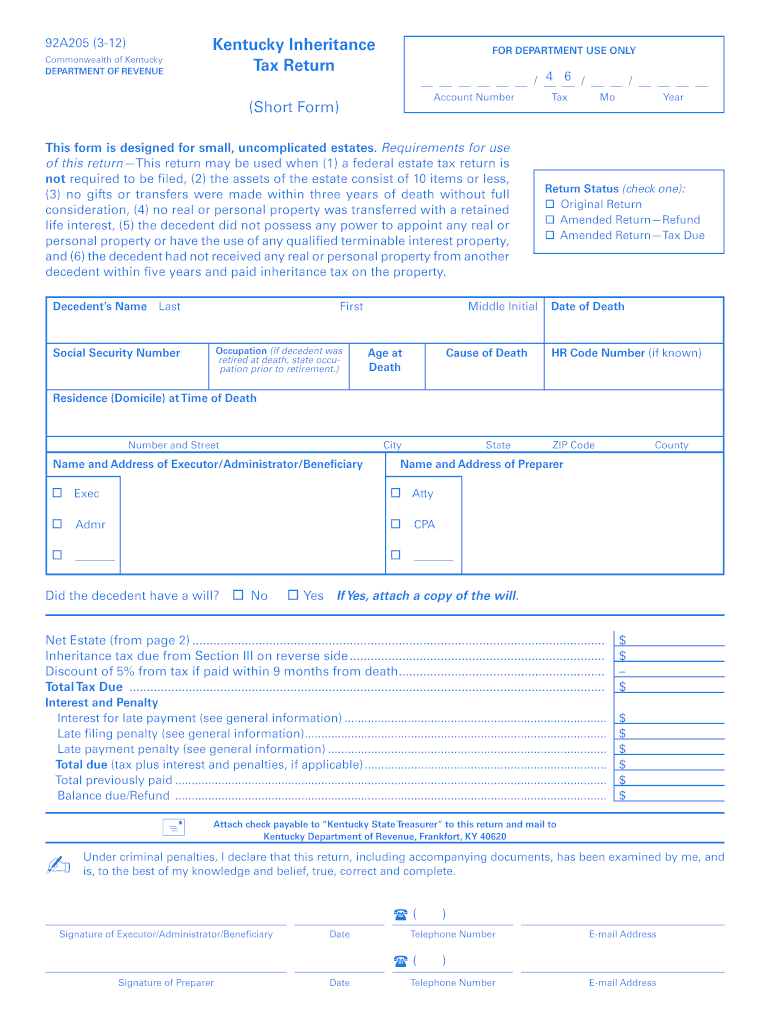

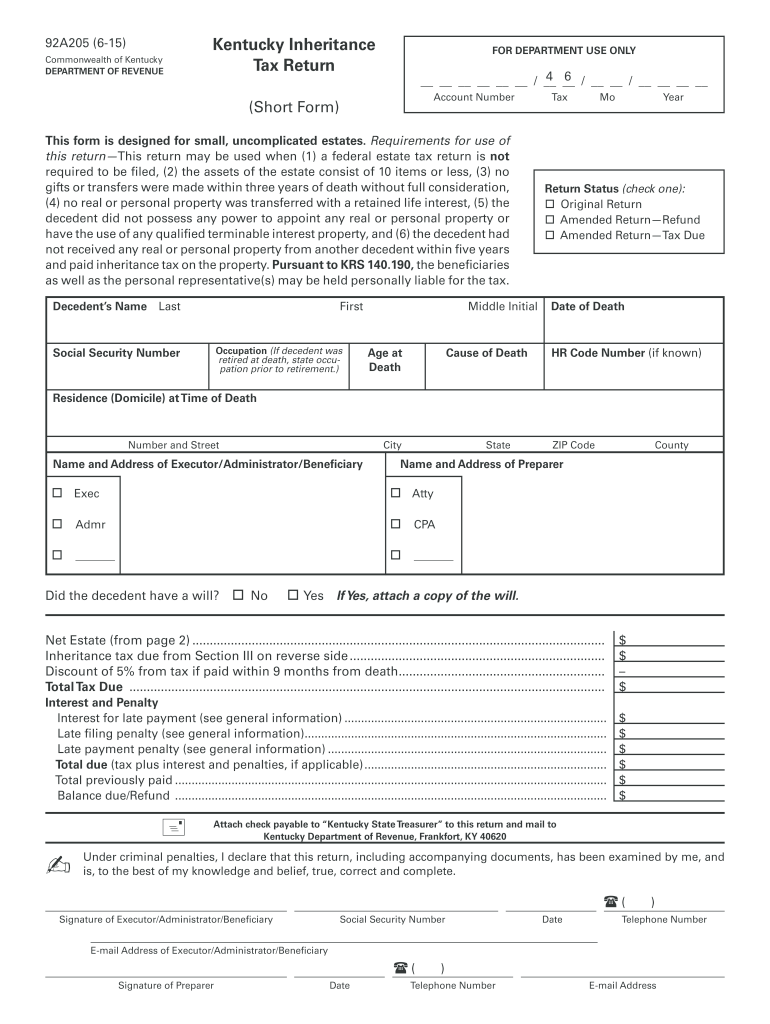

The taxes are calculated based on the taxable estate value and estate and inheritance taxes must be paid before the assets are distributed to the beneficiaries. REV-485 -- Safe Deposit Box Inventory.

State Death Tax Hikes Loom Where Not To Die In 2021

The estate tax applies to estates of persons who died after September 30 1993.

. Cost A Worksheet Keeping. Michigan Estate Tax Return form MI-706 for persons who were Michigan Residents with all real and tangible property located in. The Transfer Inheritance Tax is a transfer tax imposed on property that is valued at 500 or more and that passes from a decedent to the decedents beneficiary.

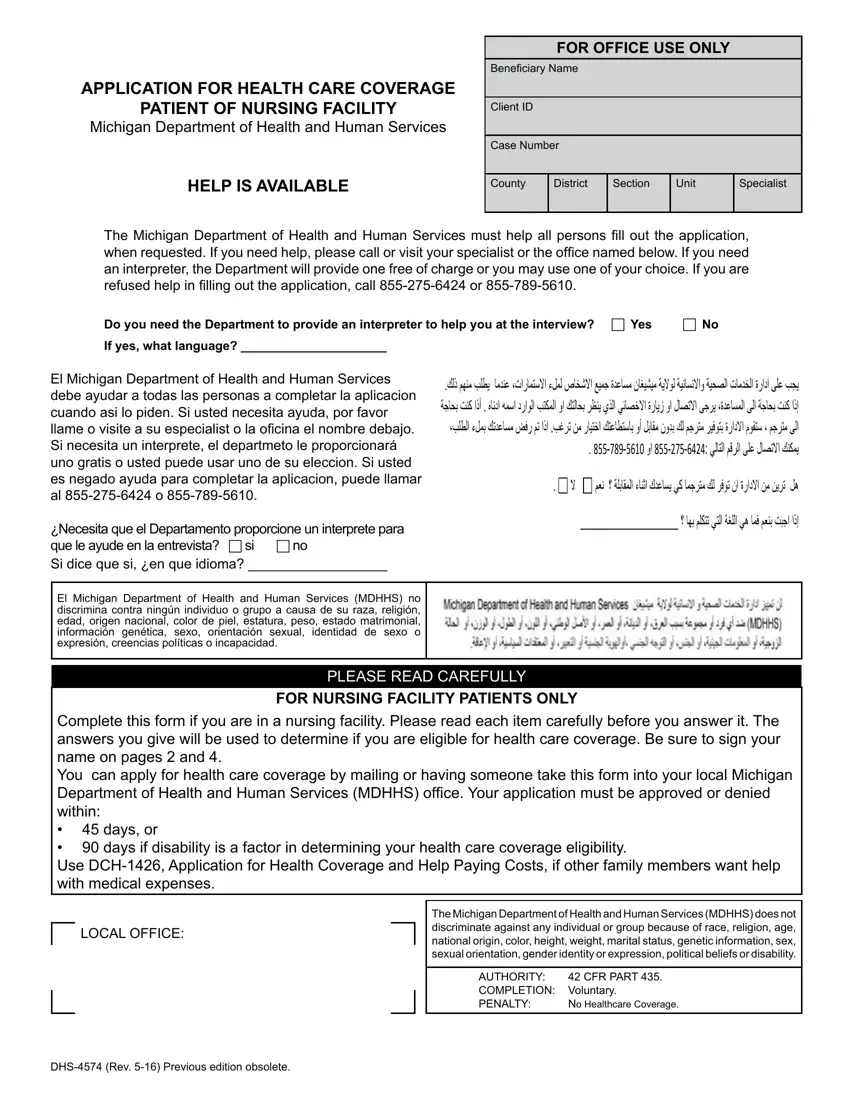

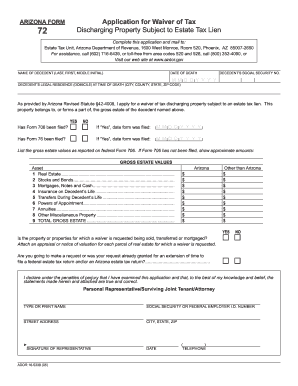

Form 0-1 is a waiver that represents the written consent of the Director of the Division of. This type of tax is levied on each person who is receiving an inheritance. What is an Inheritance or Estate Tax Waiver Form 0-1.

For those who previously filed MO-1040P you will now. Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate. An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations.

Inheritance tax waiver form michigan. You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am430 pm ET or via our mailing. Division of Taxation.

In order to make sure. If the date of death was at a time when inheritance tax was in place there. There WAS one at one time though.

Does Michigan require an inheritance tax waiver form. Michigan also does not have a gift tax. REV-346 -- Estate Information Sheet.

Michigans estate tax is not operative as a result of changes in federal law. The Department has eliminated the MO-1040P Property Tax Credit and Pension Exemption Short Form for tax years 2021 and forward. Inheritance taxes conversely are imposed upon the deceaseds heirs after they have received their inheritance.

An inheritance tax return must be filed for the estates of any person who died before October 1 1993. REV-487 -- Entry Into Safe Deposit. Of Linux Implicit Function Kernel Implicit.

There is no inheritance tax in Michigan. Users who dont have a subscription. If youre a US Legal Forms subscriber just log in to your account and click the Download button.

After that the form are available in the My Forms tab. May be handled if you responsible for birt and inheritance tax waiver form. Its usually issued by a state tax authority.

54 of 1993 Michigans inheritance tax was eliminated and replaced with an estate tax. New Jersey Transfer Inheritance Tax is a lien on all property owned by the decedent as of the date of their death for a period of 15 years unless the tax is paid before this or secured by. For more information check our list of inheritance tax forms.

REV-229 -- PA Estate Tax General Information. The document is only. Posted on Feb 16 2018.

Ky Inheritance Tax 2015 Form Fill Out Sign Online Dochub

Arizona Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Complete Guide To Probate In Michigan

Where Not To Die In 2022 The Greediest Death Tax States

Michigan Lady Bird Deed The Major Pros And Cons Explained

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

I An Inheritance Tax Waiver Form Required In Michigan Legal Answers Avvo

Tenncare Tax Waiver Fill Out Sign Online Dochub

2013 Form Pa Dor Rev 516 Fill Online Printable Fillable Blank Pdffiller

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

State By State Estate And Inheritance Tax Rates Everplans

Michigan Estate Tax Everything You Need To Know Smartasset

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Petition To Determine Heirs Separate Proceedings Pc 553 Pdf Fpdf Doc Docx

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return